Middle-income trap, brain drain and high public service spending among Malaysia’s risks

KUALA LUMPUR: A renowned global investor has called for structural reforms in Malaysia, saying that the country faces “very real” structural issues.

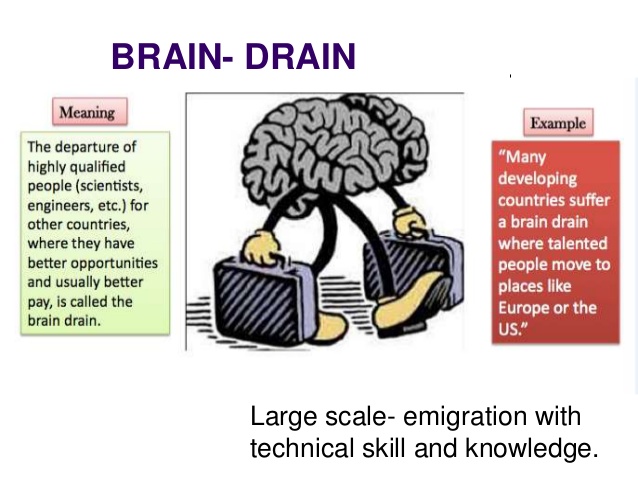

Penang-born Datuk Seri Cheah Cheng Hye (pic) who left Malaysia decades ago counts the middle-income trap, brain drain and high public service spending as current risks to the country.

Based in Hong Kong as the chairman and co-chief investment officer of fund and asset management group Value Partners Group for over two decades now, Cheah who helps manage over US$16bil in funds, however concedes that Malaysia remains a country with huge potential and opportunities.

“I don’t think we should underestimate the importance and attractiveness of Malaysia but what I am saying is that if we don’t want to be stuck forever (being) a so-called middle-income country, we need structural reforms,” he told StarBiz in a recent interview.

“Or maybe... we do want to be stuck because it is a comfortable position and because then, we can make a lot of compromises.”

“ (If that’s the case), we should be frank and say it, don’t pretend that we want to be an advanced country because that requires certain sacrifices.”

“The reality is that we are getting less and less competitive, we ranked number 23 in the latest Global Competitiveness report ,behind France and Australia which are developed countries. (Number 23) is not good enough for a developing country,” said Cheah, who recently made it to the top 40 richest Malaysians list.

Emphasising the issue of brain drain, Cheah, a former financial journalist and equities analyst said Malaysia could perhaps emulate India in this area where the concept of an Indian national overseas card has been introduced.

“I am told there are more than one million Malaysians overseas – (people like) entrepreneurs, these are exactly the type of people we want to stay here but they are not.

“We could introduce a new type of card called the Malaysian national overseas card for Malaysians who have chosen to leave the country and become citizens elsewhere.”

This card will give these Malaysian-born individuals no voting rights but will allow them to come back to work and invest here like everyone else, he said.

Cheah said this could help re-attract talent and there will be no political price to pay, because these people cannot vote here nor transfer this card to their children who would likely be foreigners.

“Some may actually come back, because it is not always greener on the other side... but you must make it easy enough (for them to come back).”

Cheah also pointed out that the amount Malaysia spends on public service is “very high” by any standards.

“Quoting from memory, about 30% of government spending is on civil service salaries and 16.5% of all employment in this country comprise civil servant jobs.

“No matter how you explain it, this is abnormally high ; something that I have learnt from my stay in Hong Kong is, keep the government as small as possible.”

He said although the civil service segment here appears to be bloated, it would be “unrealistic” to fire civil servants.

“Instead, maybe we can consider freezing and redeploying resources.

“Like any corporation, if you have too high a headcount, you freeze hiring and you redeploy people to where they are needed,” Cheah said.

Separately, Cheah, whose investments are mostly China-centric believes that Myanmar could be the next big thing.

“Nowadays, I like Myanmar because it is still cheap.

“It has about 55 million people but its gross domestic product (GDP) is only about US$65bil, Malaysia’s GDP is probably about US$320bil.

“Myanmar has enormous potential, at last they are emerging , gradually reconnecting with the world, they have (a lot of ) raw materials and are in a good position as one of the significant Belt and Road countries, China will go out of its way to invest there.”

Cheah said he would like to set up a Myanmar fund to invest in the country and is in the process of studying this possibility.

Among markets in Asia, Malaysia to Cheah, is “moderately attractive”.

He said consumer sentiment here was finally improving after it took a beating largely due to the implementation of the Goods and Services Tax (GST) back in 2015 plus there are some “interesting corporate restructuring taking place.”

Also, it is General Election year which going by history, tends to send the market higher, he said.

“I think there are good arguments why the Malaysian market is good this year but the arguments are not strong enough to result in a very strong market - and there’s also a global environment that’s not as good as last year.”

“I think the US administration is now focusing on globalisation and world trade and it seems to be moving in the direction of conflict with China over trade.

“If there is a China-US trade war, Malaysia will suffer collateral damage because we are a medium-sized player in a global supply chain, so it will be very disruptive,” Cheah said.

Upside for the Malaysian market could also be limited this year, he said, because its current valuation is relatively high at over 16 times price to earnings.

Cheah thinks the local stock market could go up by between 5% to 10% this year while the ringgit, which has mostly been on an uptrend in recent times, is “still down quite a lot”, against the US dollar.

The local unit appreciated by 8.6% against the dollar last year after losing some 4.5%, a year earlier.

At last look, it was traded at 3.9395 against the greenback.

By Yvonne Tan The Staronline

Related Links:

World Bank: Malaysia needs structural reforms - Business News

Related posts: