DUMPING U.S. Bonds for Gold! China Openly Fights the Dollar, PROMOTING the Oil-Yuan.

Gaining recognition: A person holds Chinese yuan banknotes. More economies are willing to use the yuan in clearing and payments, which is a significant step for the Chinese currency to internationalise. — Reuters

Dump Your USD!!

Why The World Is Dumping The American Dollar

Why the World Is Dumping the American Dollar | Vantage with Palki Sharma. China and Brazil have struck a deal to trade in their local currencies instead of the US dollar. They joined a long list of countries including Saudi Arabia, Kenya and India. Why is the world attempting to de-dollarise? Palki Sharma decodes

HAINAN: The Chinese yuan is speeding up in expanding its global use, a trend that will help build a more resilient international monetary system, one that is less dependent on the US dollar and more conducive to trade growth, experts say.

They commented after China and Brazil – two major emerging economies and BRICS members – reportedly reached a deal to trade in their own currencies, ditching the US dollar as an intermediary.

The deal will enable China and Brazil to conduct their massive trade and financial transactions directly, exchanging the yuan for reais and vice versa, instead of going through the dollar, Agence France-Presse reported last Wednesday, citing the Brazilian government. The report comes amid the rising global use of the yuan.

China’s first cross-border yuan-settled liquefied natural gas transaction was completed last Tuesday, after the Export-Import Bank of China achieved the first yuan loan cooperation with the Saudi National Bank, the largest bank in Saudi Arabia, earlier this month.

Zhu Min, vice-chairman of the China Centre for International Economic Exchanges, said the trend is underway that more economies are willing to use the yuan in clearing and payments, which is a “significant step” for the Chinese currency to internationalise and reflects the international community’s growing trust in it.

The financial sanctions adopted by the United States since the start of the Ukraine crisis have triggered a “crisis of confidence” for the dollar to some extent, boosting the global use of other currencies, including the yuan, Zhu said on the sidelines of the Boao Forum for Asia Annual Conference.

Zhou Maohua, a macroeconomic analyst at China Everbright Bank, said the use of local currencies in bilateral trade will be a win-win situation for China and Brazil, reducing the risk of exchange rate fluctuations facing foreign trade companies, and thus boosting trade growth.

In February, China and Brazil signed a memorandum of understanding on setting up yuan-clearing arrangements in Brazil, which is deemed by experts as a necessary infrastructure for the two economies to trade in local currencies.

The arrangements will help the two countries’ enterprises and financial institutions use the yuan for cross-border trade, and facilitate bilateral trade and investment, Foreign Ministry spokeswoman Mao Ning said.

Financial infrastructure associated with the internationalisation of the yuan should be further improved, said Pan Gongsheng, vice-governor of the People’s Bank of China, the country’s central bank, in early March.

The nation will further improve its trading and settlement system for cross-border investment and financing using the currency, Pan added.

Vantage with P... https://youtube.com/shorts/9nHUv48qWzU?feature=share via @YouTube

“I think yuan internationalisation will likely accelerate,” said Hong Hao, chief economist at GROW Investment Group, a China-based global asset management company, underlining that the recent developments indicate that an alternative monetary system outside the US dollar hegemony is being developed. — China Daily/ANN

Related:

How BRICS Is Coming Together To Challenge the US Dollar | Vantage with P... https://youtube.com/shorts/9nHUv48qWzU?feature=share via @YouTube

https://youtube.com/shorts/9nHUv48qWzU?feature=share

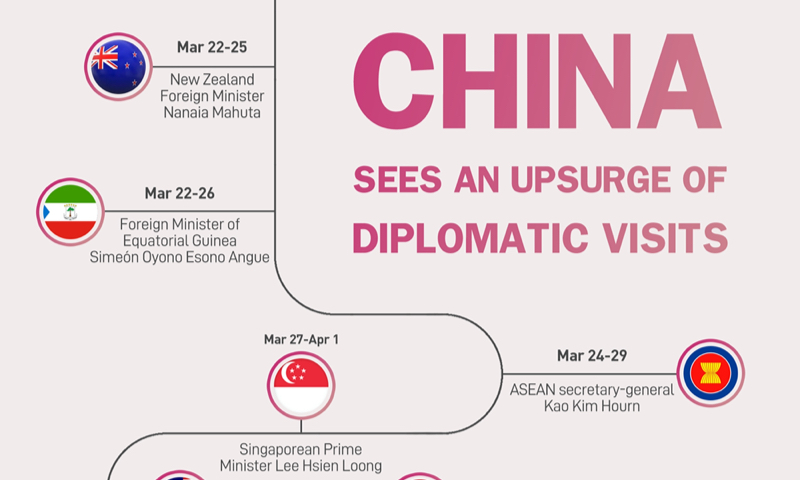

China sees an upsurge of diplomatic visits

China has recently seen an upsurge

of visits by political dignitaries of multiple countries to China. See

the infographic for more.

China's

hyperspectral satellite for Earth observation is now operational after

completing in-orbit tests, offering advanced capabilities that combine

spectra with images to detect various ground objects and specific

atmospheric components xhtxs.cn/Gtu

Related posts:

When Will the U.S. Dollar Collapse?