RCEP will promote and facilitate international trade among the 15 participating countries in the Asia-Pacific region and the expected increase in free trade will have a significant impact on the Malaysian property market. -NST/file pic.

RCEP will promote and facilitate international trade among the 15 participating countries in the Asia-Pacific region and the expected increase in free trade will have a significant impact on the Malaysian property market. -NST/file pic.The signing of the Regional Comprehensive Economic Partnership (RCEP) signifies the world's largest trade agreement and will contribute towards sustaining Malaysia as a preferred trading hub and investment destination.

RCEP will promote and facilitate international trade among the 15 participating countries in the Asia-Pacific region and the expected increase in free trade will have a significant impact on the Malaysian property market.

Higher trade and economic activities will impact on the occupation, investment and development sectors of the property market. Real estate space is a local input in the production and supply of goods and services. Increased exports lead to the expansion of domestic production.

Increased domestic production increases the demand for industrial space. Imports also have an impact on demand for real estate space. Goods imported need to be stored and distributed through warehouses and logistic properties.

These goods are then displayed and marketed at various outlets points thereby increasing the demand for retail spaces in retail malls.

Regional trading bloc and trade liberalisation will encourage foreign direct investments (FDI). These FDIs will create demand for industrial land and buildings. New capital investments will spur demand for more financing activities from the banks.

Once the plants and machines are in operations, it will create employment and demand on other factors of production. Higher economic growth will drive the capital market which will attract more foreign investment fund flows investing into local equities.

With increased economic activities, occupation demand for real estate space will cause rental increase. With inelastic new supply, potential future rental growth and prospective capital appreciation, investors will start to invest in real estate leading to an active investment market with the more participation from the institutional investors.

Developers will react to prevailing rents and capital values when they appear to signal a profitable opportunity. If prices rise, more developers will respond to these signals, the aggregate flow of supply into the market increases.

These new spaces will meet the requirements of the occupiers and investors e.g. floor plate size, specification and network connectivity requirements

Real estate service providers such as property consultants played an important role in the whole process by aligning their service standards to the requirements of the regional and global clients.

It is envisioned that the RCEP will open up markets and help in the recovery post Covid-19 pandemic. With increased economic activities, it will give rise to more derived demand for various real estate spaces thereby leading to an improved property market performance in the future.

DR. TING KIEN HWA

Professor of Property Investment

Centre of Real Estate Studies

Faculty of Architecture, Planning & Surveying

Universiti Teknologi MARA

HOC to lift property market

How RCEP could affect the property market

Related posts:; China and 14 other economies signed the world's largest trade deal, the Regional Comprehensive Economic Partn...Azmin showing the RCEP agreement document during the signing ceremony witnessed by Muhyiddin on Nov 15. – fotoBERNA...Better to buy a car or a house first?

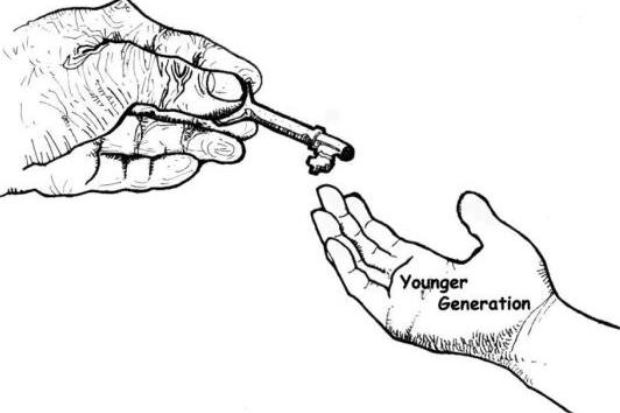

Leaving a legacy by buying a house first before a luxury car ...

Housing affordability is an income issue, what's with the fuss?

How to allocate your money wisely: lessons from my father

"The best posture is the next posture,” ergonomic expert Karen Loesing said about how workers can prevent back an.

Our cars are costing us our homes!

Our cars are costing us our homes!